The highly anticipated Knight Frank Wealth Report for 2023 has finally been released, offering valuable insights and serving as a powerful tool for investors and collectors alike. Within this report lies crucial information regarding the state of the whisky market. At EW&W, we firmly believe that whisky cask collecting is a strategic long-term endeavour, and the findings presented in the report serve to reinforce our stance.

Whisky’s Resilience in the Market:

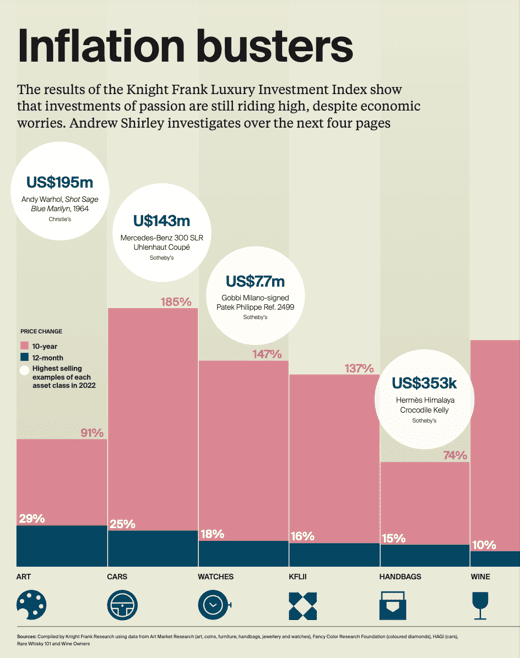

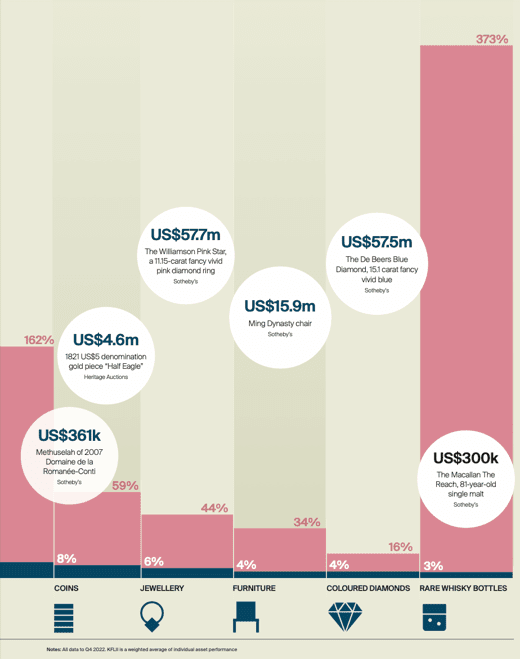

According to the Knight Frank Luxury Investment Index (KFLII), whisky has maintained its position as the leader for a decade, outperforming various luxury assets by a significant margin. Despite a modest growth of just 3% in 2022, whisky continues to demonstrate its resilience, especially when compared to other market segments.

Available to read here:

Understanding the Market Shift:

The report’s data guru, Andy Simpson, highlights a notable shift in the market. While whisky remains a strong performer overall, the growth in bottles valued at over £5,000 has slowed. Simpson attributes this shift to the entrance of speculators who aimed to quickly flip bottles for profit, leading to an unsustainable market trend.

The Long-Term Appeal of Whisky Cask Collecting:

At EW&W, we have always advocated whisky cask collecting as part of a long-term strategy. The Knight Frank Wealth Report’s findings support our belief. Whisky’s impressive 10-year growth margin, with an increase of 373%, is a testament to its enduring value and potential as a collectible asset.

Why Whisky Cask Collecting is Ideal as part of a Long-Term Strategy:

- Appreciation Over Time: Whisky casks mature and improve in quality as they age, making them more valuable over the long term. This natural process allows investors to reap the benefits of both enjoyment and potential financial gains.

- Limited Supply: Unlike bottled whisky, the supply of high-quality whisky casks is limited. As demand for premium spirits continues to rise globally, the scarcity of aged casks increases their desirability and investment potential.

- Diversification: Whisky cask collecting offers a unique opportunity for diversifying portfolios. By adding an alternative asset class, investors can mitigate risks associated with traditional investments and potentially achieve higher returns.

- Intrinsic Value: Whisky casks hold historical and cultural significance, making them highly sought after by collectors and connoisseurs. The allure of owning a piece of whisky history adds a layer of emotional and intrinsic value to the investment.

The 2023 Knight Frank Wealth Report provides valuable insights into the current state of the whisky market. While overall growth in the sector has moderated, whisky remains a compelling asset for long-term collectors and investors. EW&W firmly believes in the enduring appeal of whisky cask collecting as a strategy that combines passion, enjoyment, and the potential for long-term financial gain. By recognising whisky’s historical performance and understanding market shifts, investors can confidently embrace whisky cask collecting as part of their broader investment strategy.