Diversify Your Portfolio

Fine wine in the past has come out on top when compared against other passion assets such as classic cars, fine art, vintage watches, rare coins and stamps, jewellery, antiques and Chinese ceramics. The Knight Frank Wealth Report 2017 illustrates the excellent growth and stability of fine wine as an alternative asset class increasingly being included in the portfolios of some of the wealthiest collectors in the world.

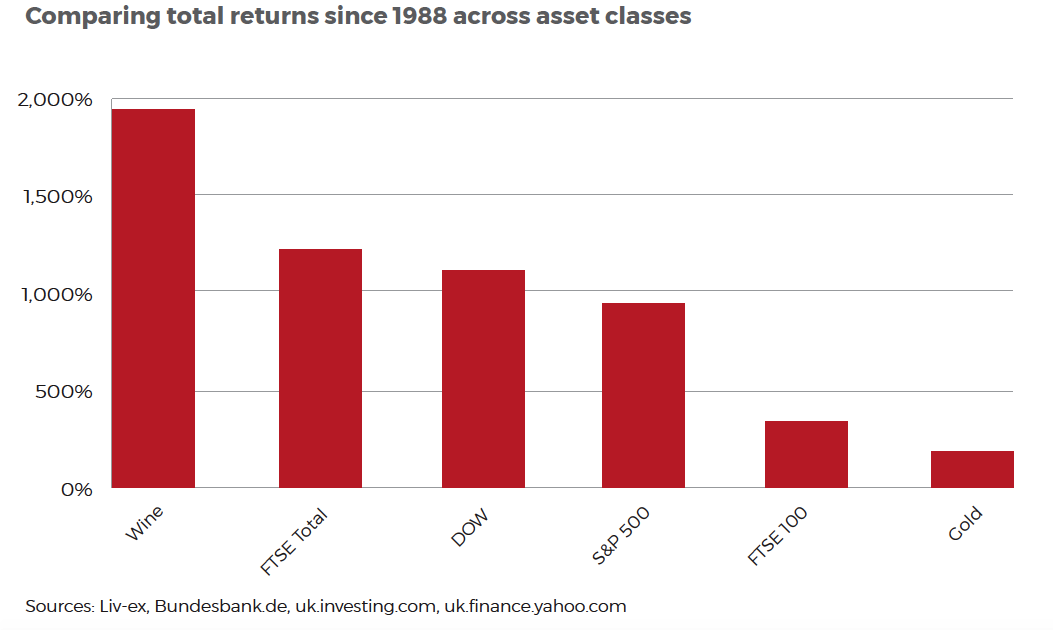

Looking closely at more recent times, November 2017 saw the fine wine index gaining 11.3% since the beginning of the year, almost doubling the gains of the FTSE 100 and out performing gold tenfold.

This was thought to be a result of buying interest broadening beyond Bordeaux to push up the prices of Burgundy and Barolo wines.

Fine wine has also proven to be less volatile than financial markets and less susceptible to market downturns, making it a favourable and popular hedge against recession, inflation, and currency devaluation. This explains why the market performed so well off the back of the Brexit decision back in 2016.