When thinking about diversifying a portfolio, many investors look to the alternative investment market due to its non-correlational relationship with the stock market.

And one such alternative investment that has been growing in popularity over the past decade is Whisky. Whisky, like fine art, vintage wines or classic cars, promises competitive returns based on the age-old principle of supply and demand. But it’s not a market that should be rushed into.

So throughout this article we’ll be breaking down the intricacies of the whisky investment landscape and providing an overview of why it may or may not be the right investment for you.

Understanding the Whisky Cask Market

Investing in whisky casks offers a highly unique opportunity; you’re not merely purchasing a commodity but investing in a product that matures and potentially appreciates in value over time.

The process is relatively simple. You could purchase a cask from a distillery in Scotland and store it in a registered warehouse where it’ll reside, quietly aging and developing complex flavours that can only be achieved with time.

To make this process even easier, you can download our comprehensive Whisky Investment Brochure. It takes you through the process and details the important documents you must collect–such as a Delivery Order, Warehouse Receipt and Certificates of Origin and Authenticity–when purchasing whisky legitimately.

This necessary admin is there for your own safety and security, but as The Times suggests, understanding the ageing process and the dynamic whisky market is also crucial, as you’ll need to master the art of predicting which whiskies will become the classics of tomorrow.

The complex nature of the whisky market is why many investors speak to specialist whisky investment houses, trained to spot future performers to suit any budget, to help advise on choosing the best option for your requirements.

Whisky Market Performance Over the Years

In 2020, the market exceeded $60 billion and is projected to grow at a 5.9% annual rate between 2021 and 2027 (Vinovest). And, rare whisky often sells for hundreds of thousands of dollars.

For instance, a bottle of Macallan 1926 was sold for a record-breaking $2.7 million at auction, showing a potential for high returns in this premium whisky market (Whisky Advocate). This surge has been fueled by increasing demand from affluent consumers worldwide, particularly in Asia, where luxury spirits have become a significant status symbol.

The coming 12 months looks likely to match the growth of 2023 (Bordeaux Index), supported by the growth of the Asian market, which is predicted to triple by 2027 as their “young, middle class, urban, educated and increasingly female drinkers” shun their baijiu beverages in favour of less alcoholic spirits from outside China (BBC News).

And one wise investor has seen a 4,600% return on a couple of whisky casks (The Independent), far higher than the average annual returns of around eight to 10%

The Positives About Whisky Investment

Whisky as an investment has numerous benefits…

- There’s proven, historical growth.

Like fine art, vintage cars, or rare coins, well-chosen whisky can increase in value over time.

- It’s an investment in something you’re passionate about.

Unlike stocks or bonds, whisky can be a source of sensory pleasure, providing a unique blend of taste and financial return.

- It’s a hedge against inflation.

Similar to gold, whisky can maintain value even when traditional investments falter.

And with stories of 586% returns on rare bottled whisky over the past 10 years (Knight Frank Luxury Investment Index), the future looks great. Although it’s important to note, this index follows rare bottled whisky, and not casks.

The Negatives About Whisky Investment

However, the market does face some challenges, the first of which for an investor is the concept of the long game. Some investments you can hold for a few years and see a return, but with whisky, it’s best to take a longer term view of 10, 20 or even 30 years into the future (The Guardian). Other things you should consider about investing in whisky are:

- It can be a volatile and uncertain market.

Whisky prices can fluctuate widely based on trends and market conditions.

- There’s a cost to store whisky.

Properly storing and insuring whisky can be costly and requires specific conditions to maintain quality.

- Market knowledge is very important.

Successful investment requires an understanding of both the product and its market nuances.

How to Invest in Whisky

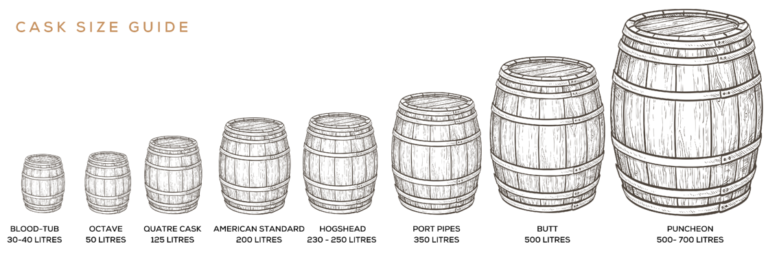

The investment pathway can start with purchasing single bottles all the way through to owning entire casks.

Nasdaq suggests that investors consider buying the whisky as young as possible as it typically enables them to buy the whisky at its lowest price, a strategy we agree with.

“Younger casks may offer greater percentage returns for those with the patience to wait, as well as a more affordable initial investment, while cask choices at an older age will require a greater initial buy-in, as they are already in their prime, but every year are projected to yield a significant return in pure monetary terms.”

At Elite Wine and Whisky, we provide a platform for buying, selling, and managing whisky investments. We offer access to a broad range of products hand-picked for your level of investment using our expert team’s knowledge.

Make Sure You’re Protected

Ensuring the authenticity and provenance of your investment is paramount. This means dealing with reputable brokers and utilising secure storage solutions to protect against physical and financial threats.

This is why at Elite Wine & Whisky we’re one of the only brokers to have our own independent storage facility that safeguards over 9000 casks for our clientele. Every client gets a delivery order upon purchase and has the Whisky stored in their own unique account meaning they have full ownership of their investment. This is the sort of level of control and transparency that you shouldn’t compromise on when investing in Whisky.

Forbes have also highlighted some of the glaring red flags to keep an eye out for when assessing Whisky Investment opportunities in this article:

1 – Avoid firms that mention a ‘586%’, ‘564%’, or ‘562%’ 10 Year ROI

2 – Beware claims of ‘guaranteed returns’

3 – You don’t really own a Scotch Whisky cask without a Delivery Order

Understanding the legalities and risks, especially in cask trading, is crucial to ensure that your investment is safe and complies with regulations.

Conclusion

The world of whisky investment is as rich and complex as the drink itself. Whether you’re drawn to the romance of ageing spirits or the economic potential of this ‘liquid gold’, whisky offers a unique avenue for diversification and is a genuinely interesting market to be involved in. Investors can potentially tap into profitable returns while learning more about one of life’s finer pleasures.

If you’re looking to delve deeper into the world of whisky investment, our comprehensive Whisky Investment Brochure is available for download. This brochure offers detailed insights and expert advice to help you make an informed decision on whether Whisky is right for your investment portfolio at this moment in time.