Whisky Market Update 22/23

EW&W are here to provide you with the most up-to-date information and insights about the whisky market. In this newsletter, we’ll be covering the latest

The whisky market was hit hard by the COVID health crisis, with a decade’s worth of lost sales, valued at 1.1 billion pounds. The most important markets for premium whisky, including the United States and Germany, resulted in a decrease pondered between 25% and 32% in 2020 alone.

Still, whisky believers and those diversifying their holdings in the rare cask market are ‘buying the dip,’ gaining an enviable position for the explosive growth expected in upcoming years. This is what you can expect from the whisky market today.

2020 saw a global decline in premium spirit sales, but emerging markets made substantial gains. Australia and China saw the most significant increases, but sales were slow in whisky’s most significant markets, including Spain, Japan, Germany, Singapore and the United States.

Still, the Japanese whisky category alone grew 42% in the last five years despite the COVID crisis, followed by American whiskey with a staggering 41% between 2015 and 2020. Scotch is not far behind, although the 2019 25% tariff imposed by the United States hindered the category’s growth. Scotch producers welcomed the suspension of such tariffs in 2021, so the Scottish whisky market is expected to catch up in the following months and years.

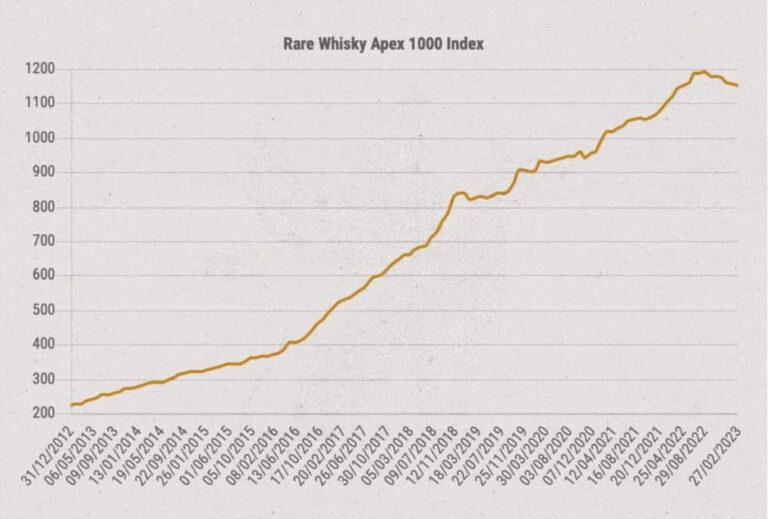

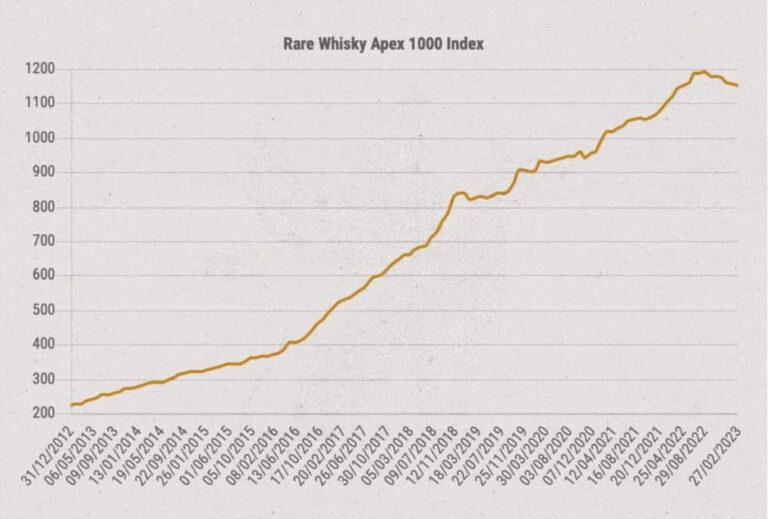

Perhaps the most notable trait of the current whisky market is its stability and increased value during a global economic crisis. Historically, whisky rises in value as it sits in the cask, even during slow market growth.

This theory was put to the test during the harshest economic downturn of the century, and whisky cask collections proved to be an extraordinary way of preserving value.

With an overall average annual capital growth is 12.84%, whisky collections over-performed gold and stocks from 2019 to date. The extraordinary cask performance has proven the whisky market is not as uncertain as it was once considered.

A study conducted by Cask 88 & Braeburn whisky over a three month period of observation, a total of 18 months, the average annual capital growth rate over their entire cask set fluctuated by less than a percentage point, a clear demonstration of the relative stability of the whisky cask market.

In the same report the study found that the top ten distilleries have maintained a solid performance within the past 6 months, projecting an average annual capital growth of 15.59%. The top 3 distilleries leading are from the Islay region. This comes as no surprise, due to the exceptional global reputation of Islay its outstanding peated single malt. The popularity of casks from the region shows no signs of abating, due to the regions high demand for quality casks far outpacing supply in the market.

The study also found a huge increase in the demand for younger casks in 2020 and the trends seems to be continuing this year. As more people are learning of the benefits of entering the market for private cask ownership the market is maturing. Younger casks are an easier entry point for collectors and collectors alike. Collecting casks at a lower entry point also plays a great role in diversifying ones portfolio.

For those with the patience to hold and wait, younger casks offer a greater percentage return, in addition to being a more affordable entry point. According to the study, on average, one can expect a recently filled cask to increase in value by 33% per year for the first three years of its lifetime. Cask choices at an older age are already in their prime and consequently will require a larger initial buy-in, however every year they’re projected to yield a significant return in pure monetary terms.

The Chinese salary has increased exponentially in the last twenty years, and the young middle class is now eager to get a taste of the modern, western lifestyle, which includes premium spirits, notably Cognac and Scotch. This authentic wave of new buyers and collectors will undoubtedly put Scotch producers to the test, with a buying pressure never seen before.

The top ten whisky distilleries in Scotland already witnessed a growth of between 13% and 19% in 2021, and the whisky cask market showed enviable stability during the past years’ rough waters, growing more and at a more stable growth than gold.

The COVID crisis and its economic downturn will eventually stabilise, and all post-covid scenarios point to explosive growth, especially for luxury goods and premium spirits.

With collectors expecting the sector’s growth to continue, increased confidence in the cask market’s stability, and fresh players coming from Asia, the Scotch market might skyrocket before the end of the decade.

As for the collectors preference, there’s no doubt there’s a market for both old and young casks, as well as for rare Scotch bottles. We’re entering a price discovery phase with unprecedented new highs. In monetary terms, the Scotch whisky market has a bright future ahead; in organoleptic terms, this will be a delicious future indeed.

Book a call today to enquire or discuss your portfolio expansion in further detail:

EW&W are here to provide you with the most up-to-date information and insights about the whisky market. In this newsletter, we’ll be covering the latest

In the world of Scotch whisky, Chivas Brothers has just unveiled some exciting news. Their recent financial report for the fiscal year 2023 reveals a

A rare cask of single malt whisky has been sold by Ardbeg, Scottish distillery for a record-breaking £16m. An unnamed female collector based in Asia,

You must be 18 or over to order with Elite Wine & Whisky

² Tax Information provided without warranty. Tax treatment is subject to HMRC guidelines – we recommend that you get your own expert tax advice for your specific situation.

As with all collections, previous performance is no guarantee of future performance.

Our website offers information about whisky cask collecting, but not personal financial advice. If you’re not sure which casks are right for you, please request advice, for example from a financial advisor. If you decide to buy whisky with Elite Whisky and Wine. Remember that whisky cask prices can go up and down in value, so you could get back less than you put in.