Hong Kong Tax Cut: Opportunity for Whisky Collectors

Hong Kong has slashed its spirits tax from 100% to 10% on bottles over HK$200, opening up the market. Previously one of the most expensive

The highly anticipated Knight Frank Wealth Report for 2023 has finally been released, offering valuable insights and serving as a powerful tool for investors and collectors alike. Within this report lies crucial information regarding the state of the whisky market. At EW&W, we firmly believe that whisky cask collecting is a strategic long-term endeavour, and the findings presented in the report serve to reinforce our stance.

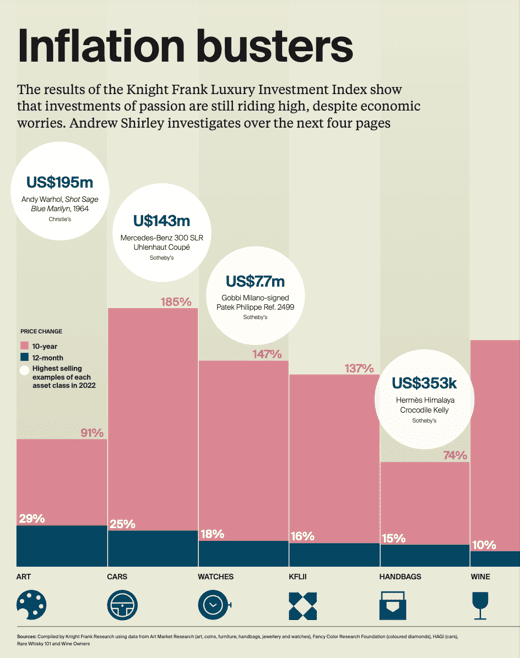

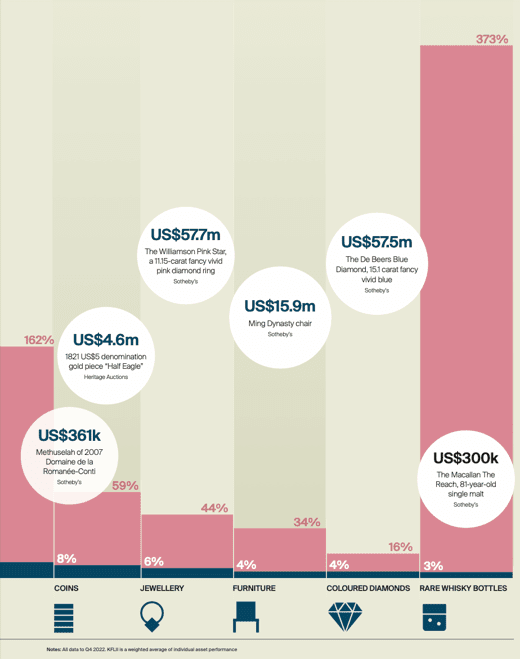

According to the Knight Frank Luxury Investment Index (KFLII), whisky has maintained its position as the leader for a decade, outperforming various luxury assets by a significant margin. Despite a modest growth of just 3% in 2022, whisky continues to demonstrate its resilience, especially when compared to other market segments.

The report’s data guru, Andy Simpson, highlights a notable shift in the market. While whisky remains a strong performer overall, the growth in bottles valued at over £5,000 has slowed. Simpson attributes this shift to the entrance of speculators who aimed to quickly flip bottles for profit, leading to an unsustainable market trend.

At EW&W, we have always advocated whisky cask collecting as part of a long-term strategy. The Knight Frank Wealth Report’s findings support our belief. Whisky’s impressive 10-year growth margin, with an increase of 373%, is a testament to its enduring value and potential as a collectible asset.

The 2023 Knight Frank Wealth Report provides valuable insights into the current state of the whisky market. While overall growth in the sector has moderated, whisky remains a compelling asset for long-term collectors and investors. EW&W firmly believes in the enduring appeal of whisky cask collecting as a strategy that combines passion, enjoyment, and the potential for long-term financial gain. By recognising whisky’s historical performance and understanding market shifts, investors can confidently embrace whisky cask collecting as part of their broader investment strategy.

Hong Kong has slashed its spirits tax from 100% to 10% on bottles over HK$200, opening up the market. Previously one of the most expensive

World Whisky Day is an annual, global day of whisky, which invites everyone to try a dram and celebrate the water of life. Taking place annually

This glossary will provide you with the key terms to discuss whisky casks. Whether you are a cask owner or an aspiring one, this glossary

You must be 18 or over to order with Elite Wine & Whisky

² Tax Information provided without warranty. Tax treatment is subject to HMRC guidelines – we recommend that you get your own expert tax advice for your specific situation.

As with all collections, previous performance is no guarantee of future performance.

Our website offers information about whisky cask collecting, but not personal financial advice. If you’re not sure which casks are right for you, please request advice, for example from a financial advisor. If you decide to buy whisky with Elite Whisky and Wine. Remember that whisky cask prices can go up and down in value, so you could get back less than you put in.